April 2020 Market Update

March 4, 2020

From the Desk of Neil McIver

During this unsettling time, we will continue to keep you informed and provide you with much-needed perspective on the current market volatility, and what we believe will happen next.

I will make this as short as possible while still providing the necessary context.

Please know that McIver Capital Management, and our Investment Committee, is working hard for you each day, in order to protect your wealth.

Off the Top

I will state three points which are critical to understanding my comments below:

1. The root cause of the current market volatility is strictly a health driven panic, not a systemic economic problem such as in past corrective cycles

2. This virus will be defeated

3. It’s all about how long it takes us to get to a post-virus environment, but this economy and this market will recover

Stopped. Damage. Recession

Much has happened since my last update on March 20th, and most events have taken place very much as we suggested they would.

Unfortunately, included in that list, is the fact our economy, and those of the G7, have effectively been stopped by virus lockdowns and forced social distancing. There is virtually no economy to speak of and at a minimum, hundreds of thousands of Canadians and millions of Americans have been thrown out of work. U.S. unemployment may indeed suddenly spike over 10% due to the lockdowns, and the President of the St. Louis regional Federal Reserve Board has estimated that U.S. unemployment could even reach as high as 30%. These numbers would match the great depression and seem unlikely in response to a temporary virus. But an alarming prediction nonetheless.

Monetary Response

This is the response to the need for capital in the larger economy in general, but most importantly among financial institutions that extend credit to each other and to individuals or corporations.

Since March 20th, there has been additional extraordinary monetary policy measures taken by both the Bank of Canada (which again on Tuesday lowered rates to just 0.25%) and the U.S. Federal Reserve, to ensure the credit markets remain solvent. This torrent of liquidity has been mirrored in a number of central banks around the world. The actions of these central banks have been staggeringly large and very swift. While we at McIver Capital Management take issue with so much firepower being used at once, we understand their concern. After all, no one knows what stopping the economy will do… to …well…. the economy. It’s just never happened before.

Additionally, no one can can be entirely sure of when governments will allow us out of our homes, to indeed restart the economy.

This is key because every day the economy remains stopped, among other concerns, there is increasing pressure on the credit system. And the credit system must hold.

Credit markets are where large institutions lend money to one another and, as such, represent the critical underpinning of our economy in general. The collective actions by the central banks are designed to support and provide confidence to the credit markets. If these markets are not kept solvent with a free flow of capital then they have a tendency to freeze up out of fear– which is exactly what happened in 2008 and exactly what caused that financial crisis. Back then, the system literally ran out of cash, because no institution had the confidence to lend to another, even overnight.

We at McIver Capital Management are confident that the both the Bank of Canada and Federal Reserve have provided enough monetary stimulus to support the credit markets and prevent any systemic economic failure.

For now.

Fiscal Response

These are the measures taken by government to mitigate the impact of the economic situation on individuals such as you and I.

There has also been a massive government fiscal stimulus plan, which, at least in Canada, has taken the form of new federal entitlement benefits (simply cheques from the government) to lessen the impact of a stopped economy.

With hundreds of thousands, if not more than a million Canadians losing their jobs, even if just some are temporarily lost, these are critically important measures.

We support these measures, however we would prefer to see a robust tax relief stimulus plan to help Canada’s businesses to eventually recover and start rehiring those out of work, as quickly as possible. These would include rolling back recent personal and business income tax increases, and a temporary GST holiday for a period of one year, among other positive steps to restart growth.

Healthcare Response

We support all professionals and workers on the front lines confronting this virus for us. Each of them is very brave.

However, some honest questions need to be asked.

Depending upon the situation, governments of all levels, particularly in Canada, are firmly requesting and increasingly ordering us to end all physical interaction and in effect, to shut down our own economy, in order to fight this virus.

This is to say nothing of the limitations placed upon our individual freedom and personal liberty.

In just 2 weeks this has already thrown millions out of work in Canada and the U.S., and will result in a recession of some unknown magnitude.

Recessions are awful things. Depending upon the depth and duration, they result in bankruptcy, economic contraction, they crush ambitions and kill innovation thereby killing future growth, future prosperity and future economic security. They result in family distress, missed educations and less opportunity for all. They also result in spiraling unemployment, millions dropping into poverty, malnourishment, family breakups, alcoholism, crippling addictions, unwanted children, hopelessness, and despair. In effect, recessions lead to mortality, and lots of it. Not just to suicide and the more obvious terrible outcomes, but also due to early disease and mental health problems.

Imagine if, in two years time, we are still in a deep recession due to this self-imposed economic shutdown, and a flu season such as the 2017/2018 season strikes. That flu season hospitalized over 900,000 Americans and killed over 80,000 of our southern neighbours. At its height it was killing over 4,000 Americans per week and hospitals were building tents outside to take the incoming patients. It killed nearly a million worldwide. How would such a flu season impact the weakened health of Canadians in a hypothetically devastated Canadian economy?

If we are considering just Canada, the misery of a recession and the accompanying increased mortality will impact all 37,742,154 of us in some way. If we consider all of the G7, that negative health impact will be felt by over 700 million people.

Recessions are not be trivialized. They are not to be played with.

The bottom line here is that if government is asking/ordering us to damage our economy and to go into a recession in order to combat this virus, then we believe that government needs to justify this action by transparently providing the underlying science, mathematics and modelling that they are relying upon to do so.

Please don’t misinterpret our comments; we do indeed agree that social distancing likely does work (and we are abiding by it as a group and individually), and we do not believe that Canada’s economy and that of the G7 will fail. In fact, we believe the recovery could potentially be stronger than anticipated. But pointing out the topography of our current situation, and the risks inherent in forcing a recession, provides both perspective and understanding.

McIver Capital Management has been consistent from the start – we believe the response to this virus by both individuals and government has not been proportional to the real risk of the virus.

Economic Summary

Let’s be honest, these monetary and fiscal measures are not ‘stimulus’ in the traditional sense. These measures, both in Canada and the U.S., represent a government bailout. You simply cannot stimulate artificially stopped economies until, and unless, those economies are allowed to function again.

The primary question now, of course, is how long the government will keep our economy on lockdown in Canada and elsewhere. Each day our economy remains stopped, some level of damage is done to it. Clearly, some of this damage will be permanent.

It really all depends upon time.

That amount of time will depend entirely upon both the fear of this virus, and the actual impact of it. Let’s all hope that both pass into history as quickly as possible.

It is important to consider the huge monetary and fiscal stimulus pumped into the system will remain in place after the apex of this virus has passed and once our economy is operating again. Assuming the current lockdown period can pass relatively quickly, this stimulus will very likely work to reignite the economy quickly in both Canada and the United States.

The potential speed and strength of the eventual economic recovery, in the view of McIver Capital Management, could catch investors by surprise.

Panic Collapse and Relief Rally

The virus-driven panic has set volatility records in most market exchanges recently including the largest single day loss for the TSX since May 1940, which was the March 12th loss of -12.33%. In addition, the greatest single day loss for the Dow since the 1987 crash, was experienced on March 16th when the Dow lost -12.93%. From there the markets continued to sell off and waterfall downward.

We were accurate in our last update on March 20th, when we stated that the markets were deeply oversold and in the range of where significant buying pressure would begin. That buying subsequently did indeed kick in. Last week we experienced two of the largest single day percent gains in the past century when on March 24th the Dow Jones gained +11.37% and the TSX jumped +11.97%. That was followed up by a +6.38% gain on the Dow and a +4.35% gain on the TSX.

These eye-watering numbers could represent great annual returns for a portfolio, as opposed to a price increase in just a few hours of trading.

To provide context we need to widen the view to look at market performance from the frothy peak in February, to the bottom (trough) thus far, on Monday March 23rd:

Dow = -38.4%

TSX = -37.8%

However, due to the recovery rally (and a reasonable few weeks to start the year before this virus appeared), since January 1st of this year the damage is less severe:

Dow = -21.29%

TSX = -22.91%

The only decline similar in speed to what we are currently experiencing was the 1987 market crash. Accordingly, we are using this as our model. We have attached an updated chart of the 1987 crash over-layed with the current correction here.

It is instructive on many levels, including the fact that the angle of decline in a market is often exactly reflected in its recovery. Slow collapses result in slow recoveries. Fast declines tend to result in fast reversals. This is an important fact to understand, as we all look forward.

Keep in mind that despite this volatility, your advanced, and mathematically constructed portfolios, have only experienced a fraction of those market losses to date. Your portfolios have done exactly what they were designed to do – protect your wealth.

What Will Happen Next

Fear will eventually abate. A floor will be created.

Over the past 6 weeks, market conditions have not been governed by fundamentals, nor economic mechanics or rationality. Rather, they have been governed by the unknown depth of mortal human fear of this virus. This truth has made it very difficult to determine the bottom of this correction.

Additionally, at the beginning, no one knew what the monetary, fiscal or healthcare responses of governments were going to be and the uncertainty created by this lack of visibility further added to the market chaos.

But that lack of visibility is significantly improving now. While there may be more on the way, both the monetary and fiscal response are now largely known. The healthcare response is evolving but it seems stable in Canada and growing quickly in the United States. These things can now be measured and assessed which will put a floor on this market.

Financial markets and people alike prefer visibility and certainty. While we are a long way from either, we seem to be moving along the continuum toward greater clarity. As such, the measured volatility of the market has fallen nicely over the past 10 days. This is measured by the VIX (Volatility Index) which is really a measure of the level of concern or panic present in the market. On a scale 0 – 100 this index normally travels along well below 20. Last weak it hit a peak of 82 (last seen in 2008) but has since nicely drifted downward (along with blood pressures) to approximately 51 at present.

Keep in mind that markets typically look six months into the future which, in this case, should be toward a post-virus environment and the eventual recovery.

The simple potential for a recovery in the economy is what the market requires before it can begin an organic increase in value and to recover its losses. The markets have already discounted projected terrible corporate earnings (-35% earning year-over-year) for 2020. Much of the bad news is already priced in to the current price of stocks. In effect, the market has priced in a recession.

Double bottom

Almost all corrections, such as we have experienced, will retest the lows experienced in the initial panic selling period. All the technical and fundamental indicators we at McIver Capital Management use as indicators suggest that we will in the very least, double bottom. This is to say, that the market will drift lower and down to the range of the March 23rd lows and retest them for strength. This is the market floor I was speaking of earlier. While this may be difficult to emotionally accept, it’s actually a good thing as it does provide us with opportunities we can use to take advantage of the current environment.

Immediately ahead of us there will likely be some bad news on the virus and its spread, as well as the possibility of celebrities or noted individuals who contract or pass away due to it. This is very unfortunate.

Additionally, there will be some negative headline news stories on unemployment and the economic impact of our stopped economy, which will likely work the market toward our expected double bottom scenario.

Again, this is ultimately positive from the perspective of solidifying the market bottom and setting us up for a recovery. Please keep in mind that the retest of the low does mean that it touches it neatly, and it may turn around before it reaches the low, or alternatively, it may move somewhat lower before the recovery begins.

Picking the exact bottom is an impossible task that we will ultimately fail at. That said, we will use our experience and market tools to the best of our abilities.

Virus driven

The above being said, this market will not organically (meaning without monetary or fiscal stimulus) begin a long-term recovery until the extreme fear of this virus abates. The only way this will be possible is if the COVID-19 negative feedback loop is broken. This is the reality I spoke of on March 20th which has resulted in nearly everyone in the western world being forced into their home because they are either quarantined, state-quarantined, self-quarantined, self-isolated, socially-distanced or simply just freaked out. People are sitting at home, on their phones, computers, watching televisions or listening to the radio. All consuming what the media is selling – which is panic.

This negative momentum needs to be broken and really the only realistic way for that to happen is for some good news on the virus and the battle against it.

We believe those news stories will eventually start to win the day, beginning in the next few weeks as the apex of this virus is reached.

Already, the original predictions of mass casualties have been walked back significantly and we expect (and hope) to see more such stories appear in the coming days and weeks.

With any luck, the breaking of the fear cycle will coincide with the market double bottom scenario described above.

3-Tranche Entry Point

We at McIver Capital Management believe, by any historic measure, that now is an attractive entry point as we approach a re-test of the market low reached on March 23rd:

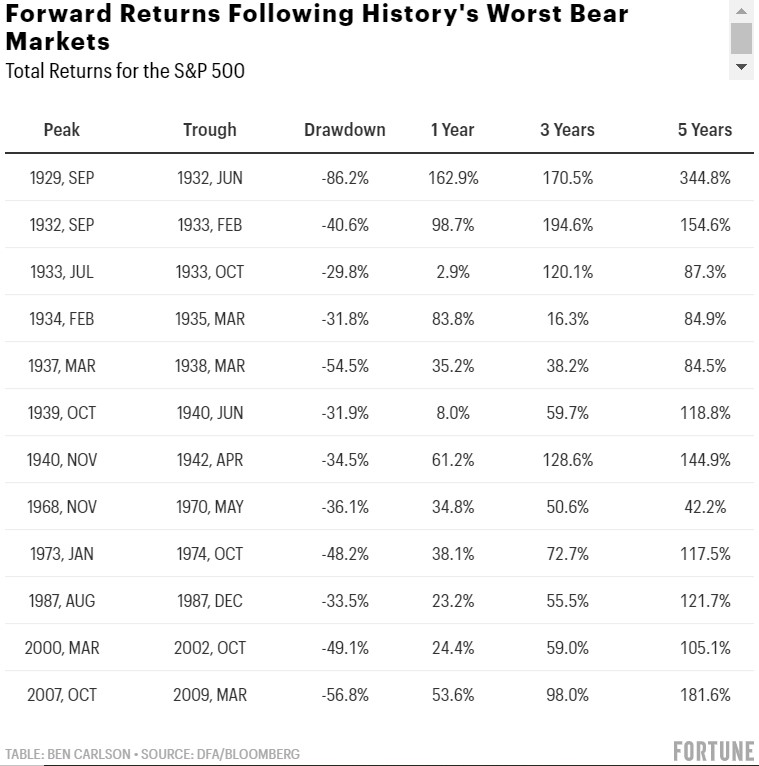

This is how markets have performed after similar corrections in the past:

A great many clients have taken advantage of this buying opportunity by sending in dormant cash and if you have not yet, I encourage you to do so. It is NOT too late in the least.

We are applying an equally weighted 3-tranche approach to adding any additional capital to your portfolio.

Tranche 1 will take place when the dollars arrive in your account. 1/3 will be deployed at these levels, some 25% below where the market was just a few short weeks ago.

Tranche 2 will be added to your portfolio at the point where we speculate the double bottom is taking place. This 1/3 will be added to your portfolio roughly concurrently with our rebalance, described below. As mentioned, picking the bottom is a difficult thing to do and we will likely not be dead accurate. That said, we will use our experience and tools to the best of our abilities.

Tranche 3 will take place following our speculative bottom call and ideally after all our indicators suggest that the bottom is in and sentiment is significantly improving. It also serves as dry powder should the double bottom not hold and the market goes lower.

Please let us know if you plan on sending in cash to your account and we will make the necessary arrangements. Of course, if you have any questions about our approach please email or call me, or any member of McIver Capital Management.

Rebalance Pending

Even if you do have dormant cash available to take advantage of this correction, a series of changes to your portfolios, which we have been working on for weeks, are pending.

Firstly, as markets have fallen our buy list has been growing. We have identified new positions which we believe will take advantage of the post-virus economic environment. We will be selling some positions (in some cases at a loss, in others, with a gain) in order to add these new positions.

Even more importantly we have accelerated our annual rebalance and it is pending should we believe that we have reached the double bottom scenario described above. At that point we will rebalance your portfolio back to its original risk-tolerance structure.

This is a powerful tool and will result in us selling the parts of your portfolio which have done the best, on a relative basis, and buying the parts of the portfolio which have performed the worst over the past year. In a general sense, currently, this would mean that we would be selling bonds, cash, gold, and food production, and adding equities.

The Case For Optimism – Revisited

The case for optimism remains strong, even in the face of an unrelenting (and irresponsible) media storm of negative news stories. Keep in mind, the likelihood of a mortal infection remains incredibly low.

Faulty input data

There is an important piece of faulty data that I would suggest you dismiss outright as effectively useless. This is the reported number of those whom have been infected with the virus. This data point means nothing, unless the entire population of the planet is tested daily. It does not indicate the spread of the virus, nor if it is getting worse or better. It just loosely reflects the number of people being tested, which is increasing rapidly. The more robust a healthcare response a country has, the more testing it will do, and the higher the number of cases of the virus will be found. So, toss that number away.

If you wish to understand the spread, unfortunately you need to look at mortality for an understanding. But that brings us to a second piece of questionable information.

The second piece of faulty of data is more difficult to discern, and that is that in some locations (Italy and New York for example), they list people whom have passed away with the virus as have being killed by the virus. This will grossly inflate the numbers of people killed by the virus. I will spare you the details, but if you have any experience of a family member or friend passing away, you will understand the difference.

The Future

As we move through time, the apex of this virus will be reached. Perhaps within days.

As the apex is reached and then moves behind us, the tone of the news coverage will likely improve to a degree as collectively, the fear of this virus abates.

One way or another this virus and its impact will be mitigated in the short term. A vaccine is on its way. This virus will be defeated.

It is important to consider the growing and deep reservoir of good news stories to come. These will be of survival, or heroic efforts to mitigate the virus. We will hear stories of public parks opening again, of schools opening again, of borders being re-opened and flights resuming. We will hear of sports leagues re-starting and cancelled events being re-booked. We will hear of restaurants and pubs re-opening. We will once again get together with friends and family.

That is powerful fuel for the collective.

The summer is coming.

As Billy Graham said once “I’ve read the last page. It’s going to turn out all right.”

Reading & video

This gentleman, a mathematician and an author, calculates real mortality risks using data from the World Health Organization: Link

This article explores how the widely published original projection models from a number of weeks ago, which showed millions of Americans dying of the virus and 500,000 British succumbing to it as well – the equivalent of about 370,000 Canadians dying – have been cut back to just 1/10 of the original projection: Link

Close

Please be healthy and do all you can to be both mentally and physically strong.

Do not hesitate to call, email or text me should you want to chat.

While I may be writing this, it is with research and perspective from every single member of our team at McIver Capital Management. I’m very proud of each of them, and in particular of their personal and professional commitment to you.

We are all here for you.

Sincerely,

Neil McIver

Consistently Working in our Clients’ Best Interest

The comments and opinions expressed in this newsletter are solely the work of McIver Capital Management, not an official publication of Canaccord Genuity Corp., and may differ from the opinion of Canaccord Genuity Corp’s. Research Department. Accordingly, they should not be considered as representative of Canaccord Genuity Corp’s. beliefs, opinions or recommendations. All information is given as of the date appearing in this newsletter, is for general information only, does not constitute legal or tax advice, and the author McIver Capital Management does not assume any obligation to update it or to advise on further developments related. All information included herein has been compiled from sources believed to be reliable, but its accuracy and completeness is not guaranteed, nor in providing it do the author or Canaccord Genuity Corp. assume any liability.

CANACCORD GENUITY WEALTH MANAGEMENT IS A DIVISION OF CANACCORD GENUITY CORP.,

CANACCORD GENUITY CORP. IS A MEMBER OF THE INVESTMENT INDUSTRY REGULATORY

ORGANIZATION OF CANADA (IIROC) AND CANADIAN INVESTOR PROTECTION FUND (CIPF)

Do You Want To Know More?

Give us a call, let's have a chat.

Ask all your questions, get all the answers and hear about all the benefits. Don’t worry, we are sure we can find a custom solution for your specific case.

Call us at +1 (604) 643-7337

Email us at nmciver@cgf.com