Market Forces 010

April 14, 2023

Market Commentary

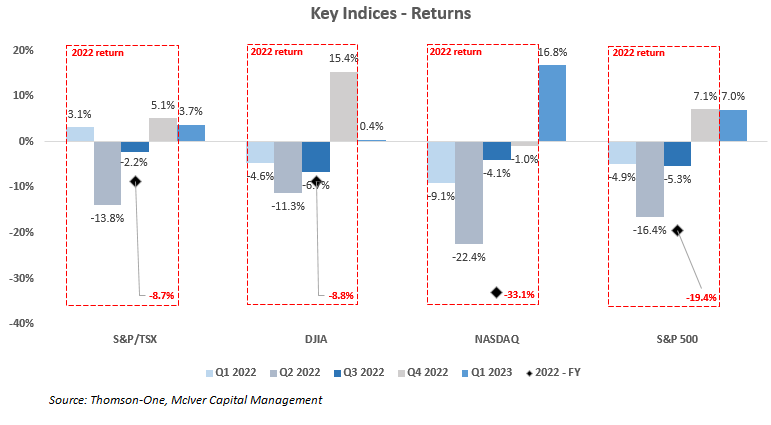

After a disastrous 2022, the positive momentum seen in the last quarter of 2022 continued into the first quarter of 2023, with the S&P 500 and NASDAQ up 7% and 17% respectively in the quarter. The DJIA was the exception, with its higher underlying financials sector exposure dragging down its performance (flat in the quarter).

The first two months of the quarter were characterized by relatively low levels of volatility with the VIX (a measure of market volatility) around the 20 level. The relative calm was short-lived, with the failure of two US banks (Silicon Valley Bank and Signature Bank) introducing fears of systemic risk in the US banking system. This resulted in a spike in the VIX to levels in excess of 30 and negatively impacted the performance of the banking sector.

The response by the US regulator was swift, with the Federal Deposit Insurance Corporation (FDIC) stepping in to protect depositors, and the knock-on effect forcing the Fed’s hand (essentially constraining the Fed to a 25 basis point hike in its battle against inflation). Financial markets found some comfort from these actions, with the VIX settling back to sub 20 levels, and the markets resuming their upward momentum.

After falling in price significantly in 2022, the performance of bonds exhibited a similar if not more pronounced volatility pattern relative to equities.

The key 20-year US treasury bond rallied in January (yields fell by ~50 basis points), then gave up much of those gains with a reversal in February (yields rose by 40-45 basis points), only to again reverse course, rallying in March. It’s worth noting that three distinct moves of the magnitude seen year to date are an infrequent and extreme occurrence.

Commentary vs forethought (ex-post vs. ex ante)

In the fast news, social media-dominated world we live in, I have begun to apply my mind to the importance of the difference between commentary and forethought.

Firstly, a key admission. Whilst I am an infrequent poster on social media of any kind (my dog’s Instagram being a notable exception), I absolutely find value as an observer of posts/news flow streaming across my LinkedIn feed. This is obviously an anecdotal observation, a product of the degree of quality of my network contacts, and some undoubtedly sophisticated algorithm.

What I have observed most notably over the recent past, is a proliferation of what I would call rear-view mirror commentary; to my eye, two items stood out as distinct to me.

Firstly, the early January commentary had a common thread of references to the difficulty of the financial markets, and often some allusion to how this have evolved in line with the poster’s prior view. Suffice it to say, locating these referred-to articulated views has proven unsurprisingly difficult.

Secondly, as mentioned earlier, a notable event in the quarter was the failure of two regional banks in the US, collectively representing the largest banking failures (by assets) since the height of the global financial crisis (around 2008/2009). In the hours and days that followed, my feed was dominated by a litany of posts highlighting the issues of where these banks went wrong. A lot of this was robust, well-thought-out commentary to be fair, but I think we would all agree the value of these remarks would have been exponentially more valuable before the event as opposed to after.

To be clear, I do not intend this to be construed as criticism, rather I wish to highlight the importance (necessity?) of making a clear distinction in social media consumption, between commentary (what happened), and forethought (an explanation on what one believes may happen).

Commentary is backwards looking (ex-post) and give perspectives to what has happened, forethought is forward-looking (ex-ante) and hopefully gives vision into what may happen.

To use, potentially badly, a sports analogy, commentary is great for spectators (having the views of experts to help digest what is going on on the court or field); forethought however is what is required for players/participants to help them adjust their game to maximize performance.

A moment to reflect after a year of commentaries (forethoughts?)

With this publication marking the tenth in the series, I thought it helpful to provide a brief recap on our views articulated below.

The investment industry is notorious for individuals displaying selective memories when referring to past statements or commentaries. I have provided a very brief overview on prior “Market Forces”, but I would encourage you to read the pieces to assess for yourself the degree to which the summation is intellectually honest.

Key insights from Market Forces 001-009:

- Warning on inflation and rates risk early in 2022, and continually doing so before the market began to price it in (and the bloodbath in fixed income)

- Calling a peak in inflation (before it peaked), but also highlighting that peak inflation was the last battle, and the moderation (i.e. the reversionary path down) was what was important

- Highlighting earnings risk, around June 2022 before earnings expectations eroded

- Advocating for value vs. growth and stock selection (and indicating desirable attributes)

- Highlighting the value of stock selection in more difficult, volatile markets

Read our previous Market Forces articles here

A robust start to the year from markets is welcome, but we continue to caution that discipline is key. On aggregate, valuations are not overly compelling, elevated corporate margins (and consequently profitability forecasts) remain a risk. Whilst the step down in inflation is welcome, we remain concerned it may remain at elevated levels longer than anticipated by the market.

For those interested in hearing a more nuanced and broader explanation of this, click on the link below to be directed to a recent fairly concise (sub 15 mins) presentation I gave.

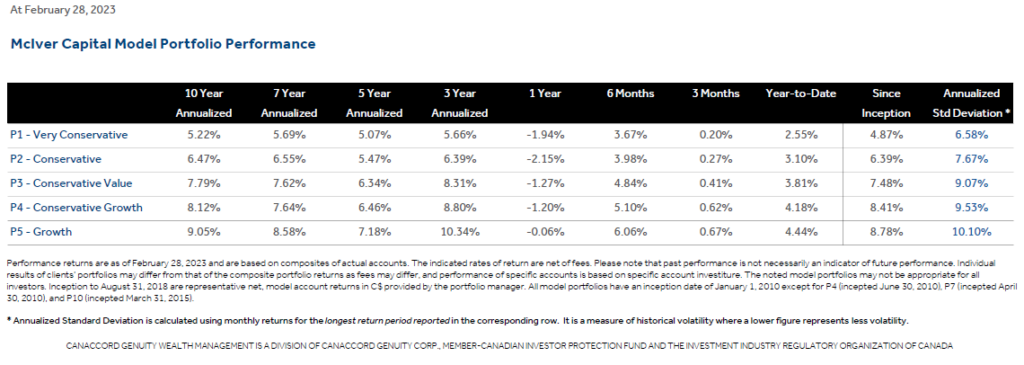

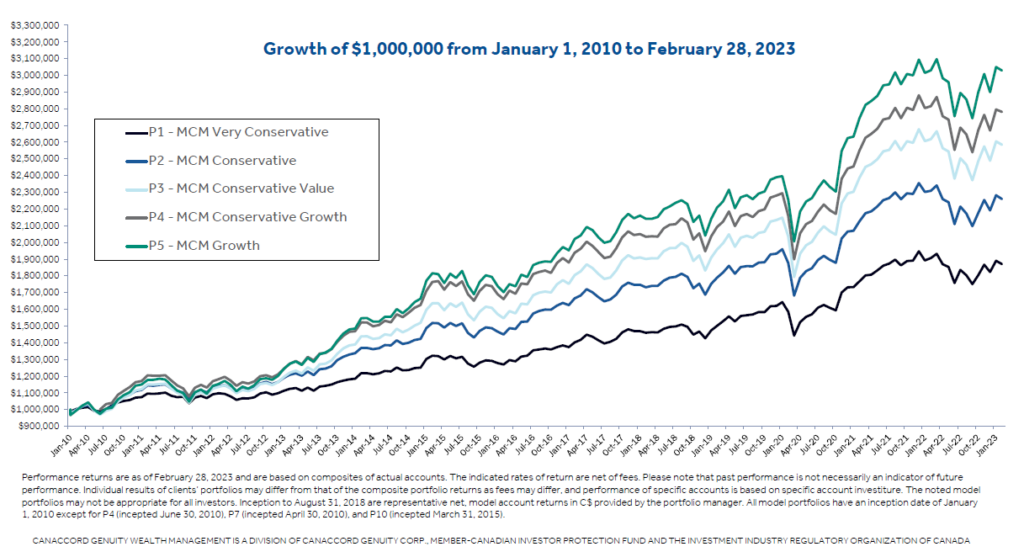

We remain grounded in our focus on asset allocation, augmented by undertaking robust fundamental analysis and we believe the resilient performance of your portfolio is testament to the rigorous process we employ.

Sincerely,

Warren Goldblum

wgoldblum@cgf.comOn behalf of McIver Capital Management

MCIVER CAPITAL MANAGEMENT PERFORMANCE (click here)

(Net-to-client, third-party audited)

Do You Want To Know More?

Give us a call, let's have a chat.

Ask all your questions, get all the answers and hear about all the benefits. Don’t worry, we are sure we can find a custom solution for your specific case.

Call us at +1 (604) 643-7337

Email us at nmciver@cgf.com